Covéa, France’s largest insurance group, is to accelerate the processing of its policyholders’ claims across its three brands – MAAF, MMA and GMF – with an AI that analyses damage to cars.

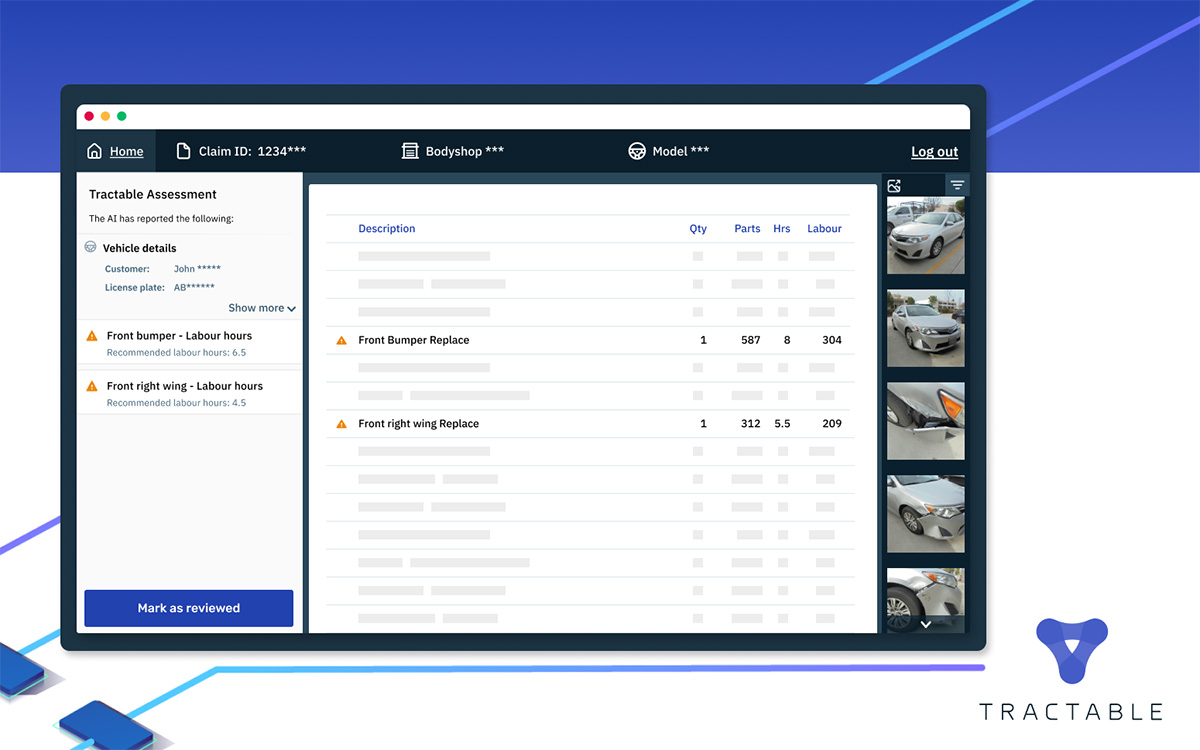

The AI solution, created by technology company Tractable, uses computer vision technology to understand photos of car damage taken by bodyshops in France, making sense of the impact as a human would.

In 2021, Covéa is deploying Tractable’s AI across its networks of thousands of French bodyshops, where it will assess auto claims from its three insurance brands in real-time, and on a national scale.

By speeding up decisions and making the process more efficient, the AI makes it possible to analyse claims in a few minutes, instead of a few days. It will also ensure bodyshops follow the most appropriate and safe repair methods, and allow experts to focus their attention on more complex tasks. In addition, speeding up and simplifying the process with AI will enable the policyholders from Covéa’s brands to recover their vehicles more quickly.

Bruno Lacoste Badie, Expertise and Indemnity Solutions Director at Covéa, said: “Using AI to accelerate claims assessment is a step change for policyholders of the MAAF, MMA and GMA brands, and for our repair service providers. In addition to making claims handling more efficient, Tractable’s AI will allow all stakeholders to make better, more accurate decisions that benefit everyone.”

Covéa has worked with Tractable since 2016 to simplify claims management. To deploy the technology nationally, Covéa set up the ExcellIA partnership, which includes the service platform Darva and bodyshop solutions providers such as Lacour, alongside AI specialist Tractable. The collaboration brings together the major players across the French repair ecosystem, and allows participants to easily use and benefit from the new technology on a daily basis.

Adrien Cohen, co-founder and President, Tractable, said: “This collaboration means our technology will be making a positive, tangible difference to every part of the French auto repair sector. With our AI, a repairer won’t have to wait on approvals from an assessor in person, but can move a repair on immediately – giving them more autonomy, helping them to work on more vehicles, and ensuring expertise is directed to complex claims. The aim is to get the insured back on the road, as quickly as possible.”

Tractable’s AI uses deep learning, along with machine learning techniques. Its AI is trained on many millions of photos of car damage, and the algorithms learn from experience by analysing a large variety of different examples.

The AI allows insurers to evaluate the damage to a vehicle, based on photos provided by repairers, appraisers or consumers. Via a platform, Tractable’s AI shares repair method recommendations and guides the process to ensure each claim is processed and settled as quickly as possible.

The AI acts as a real-time coach, recommending best practice and safest repair methods to Covéa’s partner workshops. Each bodyshop benefits from the training of other players, as the data is shared to elevate repair standards across the ecosystem.

Tractable’s AI has processed over $1 billion in auto claims for over 20 of the world’s top insurers, including Ageas, one of the largest auto insurers in the UK, Tokio Marine and MS&AD, the largest auto insurers in Japan, and PZU and Talanx-Warta, the largest auto insurers in Poland.