The number of vacant positions advertised by startups in the OurCrowd portfolio rose dramatically from a peak of 836 in Q2 2020 to 2,628 at the end of Q2 2021. The number of companies in the portfolio reporting vacancies through the OurCrowd platform grew from 101 to 148; the number of vacancies posted on average by each company during this period more than doubled from 8.3 to 18.7.

During Q2 2021 an average of 31 new vacancies were added each day to the OurCrowd Jobs Page compared to 15 during Q1 2021, 14 in Q4 2020 and 13 new vacancies each day in Q3 2020. This reflects 200% growth since the previous quarter, following a steady growth of 7% each quarter since 2020.

Only 13% of portfolio companies are planning to hire less staff than before the Covid-19 pandemic began in Q1 2020.

OurCrowd is an investment platform that invests in startups, early stage companies and venture funds.The company is based in Jerusalem andwas launched in February 2013, with overseas branches in the United States, the United Kingdom, Canada, Australia, Spain and Singapore.It uses equity crowdfunding as its model where investments into a company’s shares are pooled together from the crowd. OurCrowd gives each investor the ability to choose the individual companies in which to invest.As of October 2020 OurCrowd has over 1.5 billion dollars in committed funding.

The key points of OurCrowd survey:

- Job vacancies at OurCrowd companies in Q2 2021 soar 300% year-on-year to more than 2,600; openings at each company more than double from 8 to 19

- 5% of OurCrowd companies re-open their offices as hybrid work patterns spread throughout the high-tech industry

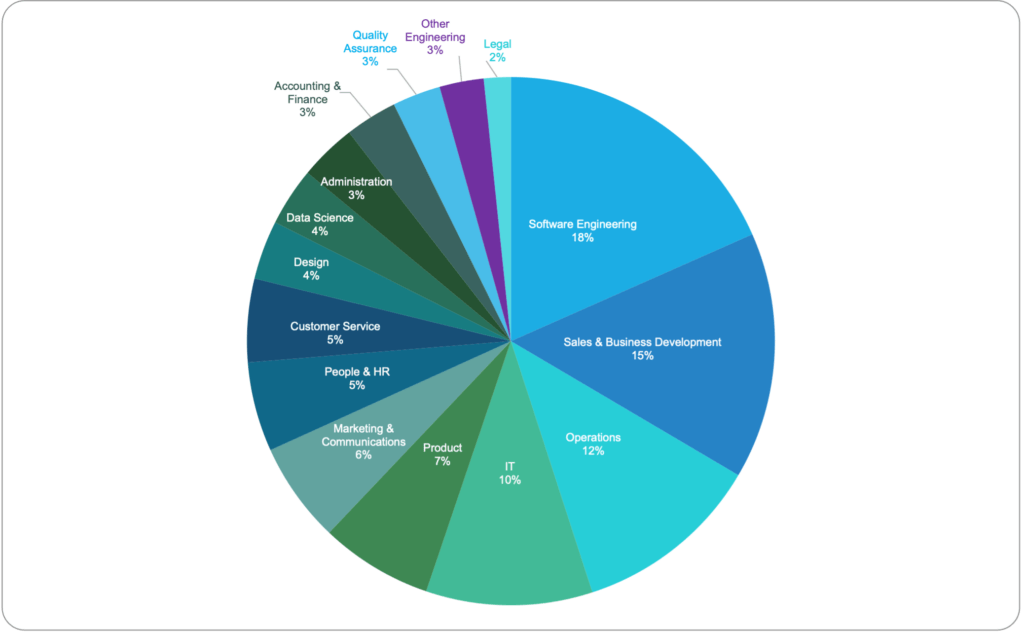

- Software engineers and business development remain the roles most in demand

- With pandemic in retreat, nearly two-thirds of companies surveyed say they plan strong hiring for the rest of 2021; two-thirds of executives surveyed say it’s a job seeker’s market

Software engineers, business development staff most in demand

As was the case in Q1 2021, software engineers remain the most in-demand category, with 18% of openings. Business development staff were a close second with 15%.

In Israel, 35% of entry-level sales and business development staff earn NIS 12-16K/month, with roughly equal numbers making either more or less. Over 51% of mid-level sales and business development staff earn more than NIS 20K/month. 74% of senior executives earn more than NIS 24K.

“Ravin AI continues to grow, recruiting 26 people over the past 6 months in software development, algorithm development, customer success, UI and product specialists, with a new development center in Austin Texas, and exciting new opportunities,” says Dganit Vitner, VP HR, Ravin.

Remote and hybrid work are here to stay

95% of companies have reopened their offices; only 13% of companies have staff in the office full time, while 80% are implementing a hybrid model with some employees in the office, some part time and some at home. Even in Israel, which is a world leader in the percentage of its population vaccinated against Covid-19, 77% of companies expect to continue the hybrid model at least through December 1.

“As the spread of the Delta variant throws workplace planning in doubt once again, the widespread adoption of remote working patterns suggests many high-tech companies will be able to continue their business activities with minimal disruption,” says Laly David, Business Development Partner at OurCrowd. “Most important, the trend of hiring employees from peripheral geographic areas is here to stay and fortunately even grow.”

The CEO of NeuReality, an OurCrowd portfolio company, Moshe Tanach says: “COVID created an urgent necessity that pushed us to adopt a hybrid work environment that is critical, especially for new employees. In NeuReality, we are committed to maintain and improve this new working model, no matter what will happen with the COVID pandemic. We believe it is an essential component in our future success.”

With remote work becoming common over the past year, 35% of our Israeli companies are more positively inclined to hire employees from peripheral geographic areas beyond the main high-tech triangle between Tel Aviv, Haifa and Jerusalem. Another 55% said they were already positive about hiring employees from the periphery pre-Covid.

Companies based in the periphery are opening offices in the main centers as employees become more accustomed to working remotely across multiple sites, or from home.

“Morphisec is moving from the start-up phase to the scale-up phase and has doubled its workforce since the beginning of 2021 across Israel, the US and India,” says Michal Gilboa, VP of Human Resources at Morphisec. “In an effort to address the needs of our employees while growing during Covid, we have opened a small Tel Aviv office in addition to the Beersheba HQ to enable employees to work partially at an office while reducing commute time.”

“Lately we opened a new office in Tel Aviv to expand our exposure to a wider talent base. Having a hybrid work environment is a critical component nowadays and NeuReality fully understands and supports that,” says Moshe Tanach, CEO, NeuReality.

“COVID created an urgent necessity that pushed us to adopt a hybrid work environment that is critical, especially for new employees. In NeuReality, we are committed to maintain and improve this new working model, no matter what will happen with the COVID pandemic. We believe it is an essential component in our future success” – stated, Moshe Tanach, CEO, NeuReality.

Zoom effect on sales teams

Thanks to Zoom and other virtual meeting technologies, many companies found that they had no trouble sourcing and closing B2B deals from a single location during the height of the pandemic. While 78% of respondents said they are planning to either maintain or expand their sales teams abroad, it’s significant that 22% are now re-thinking their strategy relative to overseas sales staff.

Jumpcloud survey:Benefits and headaches of remote working

OurCrowd portfolio company JumpCloud conducted a survey of SME IT professionals worldwide in June 2021 to explore post-pandemic priorities for the IT community. The survey affirms expectations that remote work is here to stay: over half plan to spend more on remote management and security technologies. Nearly three quarters said IT budgets had increased during 2020 (although only one third saw pay increases).

When asked “what are the reason(s) for choosing the IT technology/technologies you selected,” 59% said “works with my existing technologies” – but the second most important factor was “ideal for remote work environments.” Three quarters of the IT professionals said that remote work makes it harder for employees to follow good security practices.

Managing the remote work force isn’t easy: nearly two thirds of the IT executives agree with the statement, “I feel overwhelmed trying to manage remote work.”

Israel seeks to increase high-tech workforce

The Israeli government has announced that it wants to grow high tech’s share of the workforce from 9.8% in 2020 to 15% by 2026. Our survey respondents are bullish on high tech: over two thirds expect this goal will be met.

Survey Findings

1. Total number of vacancies in OurCrowd portfolio companies

1A. Total vacancies: Q1 2021-Q2 2021

As of July 4th, 2021, there were 2,774 vacancies in 148 OurCrowd portfolio companies, up from 1,431 in 101 companies at the start of the previous quarter. The number of vacant positions advertised by startups in the OurCrowd portfolio rose dramatically from a peak of 836 in Q2 2020 to 2,628 at the end of Q2 2021. The number of companies in the portfolio reporting vacancies through the OurCrowd platform grew from 101 to 148; the number of vacancies posted on average by each company during this period more than doubled from 8.3 to 18.7. During Q2 2021 an average of 31 new vacancies were added each day to the OurCrowd Jobs Page compared to 15 during Q1 2021, 14 in Q4 2020 and 13 new vacancies each day in Q3 2020. This reflects 200% growth since the previous quarter, following a steady growth of 7% each quarter since 2020.

1B. Location of high-tech job vacancies

During Q2 2021, 64.36% (3,097) of the jobs posted on the OurCrowd Jobs Page were in the United States, 16.13% (776) were in Israel, and 6.11% (294) were classified as fully remote jobs.

2. Companies’ plans for hiring in 2021

What is your company’s employee growth plan for the remainder of 2021?

2A. Companies’ hiring plans, Q2 2021

61% of companies say they plan strong hiring through the rest of 2021, a nearly 50% increase from the previous quarter, when only 43% planned strong hiring.

2B. Companies’ hiring plans, Q1 2021

3. Hiring patterns in Q2 2021 compared to Q2 2020

3A. Companies’ hiring patterns

Compared to this period one year ago, pre-Covid lockdowns, is your company:

In Q1 2021 only 36% of companies said they were hiring more new employees this year than last, but this jumped to 61% in Q2, It appears our portfolio companies are getting past the Covid-induced slowdown.

3B. Market for job seekers or employers?

Based on the hiring needs of your company and the quantity/quality of candidates that you are seeing, is the current job market a:

68% of companies surveyed consider the current conditions in high tech to be a job-seekers’ market. 16% say it is an employers’ market and 16% say it is balanced between the two.

4. Remote vs on-site work

4A. Plans for remote vs on-site working

With Covid regulations rolling out this year, by December 1, 2021 do you expect your employees will be working remotely, back at the workplace, or hybrid between remote and workplace?

The number of companies that expect to see a hybrid model approximately six months in the future increased slightly from 75% last quarter to 77% now, despite far greater vaccination levels. This could indicate a greater acceptance of hybrid work as a long-term model, not just a short-term stop-gap measure, and perhaps reflects continued uncertainty about the effect of the pandemic on work patterns.

4B. Working from home or office?

If your office has reopened, are your employees:

Our survey results show the dominant workplace model for today is hybrid, with 81% of companies expecting their employees to work in the office part-time, up from 75% in Q1 2021. With the future of the pandemic still uncertain, the hybrid trend seems set to continue. The proportion of companies expecting to return to full-time office work fell to 13% in Q2 compared to 21% in Q1. This is lower even than the 14% of respondents who already thought they would soon return to full-time office work in our first survey for Q4 2020. The proportion of offices still closed fell to 6% against 15% in Q1 2021.

4C. Readiness to hire employees from the periphery

With remote work becoming more common, has your readiness to hire employees from the periphery changed?

The success of remote work during Covid has led 35% of employers to view more positively the prospect of hiring employees from the peripheral outlying areas of Israel beyond the traditional high-tech triangle of Tel Aviv-Haifa-Jerusalem. 55% said their attitude toward hiring employees from the periphery has always been positive, leaving only about 10% of our portfolio companies that do not seem enthusiastic about extending the geographical location of their staff.

5. Demand for different positionsWhich professional roles are in increased demand?

5A. Job vacancies posted Q2 2021

The positions most in demand in Q2 2021 were Software Engineering, Sales & Business Development and IT, as in Q1. The proportion of vacancies in Operations halved, while demand for new staff in Product and Marketing & Communications increased.

5B. Job vacancies posted Q1 2021

5C. Professions in demand

Which professional roles saw increased demand in your company since the Covid pandemic began?

More than two-thirds of companies surveyed said they needed more software engineers since the start of the pandemic.

6. Salaries:Sales and business development professionalsSales and business development is the second-most in-demand job role, according to the OurCrowd Q2 survey. In your company, what is the average monthly salary range in New Israeli Shekels (NIS) for:

6A. Entry-level sales and business development

6B. Mid-level sales and business development (3-5 years)

6C. Senior sales and business development (7-10 years)

Most entry-level sales and business development staff in Israel can earn at least 12,000 NIS/month and nearly a third earn more than 16,000 NIS/. More than half of mid-level sales and business development employees earn more than 20,000 NIS/month, while the four-fifths of senior sales and business development executives earn 24,000 NIS/month or more. The average Israeli salary is about 12,100 NIS/month. The average Israeli high-tech salary is about 28,800 NIS/month.

7. Most popular OurCrowd portfolio companies

Portfolio companies with the most clicks on their jobs ads in Q2 2021

JumpCloud Cloud-based directory software simplifies and unifies identity management, enabling secure connection to workstations, networks, apps, and files from any location.

Bizzabo Control center for event planning and attendee experience that consolidates logistical, promotional, and social tools.

TechSee Smartphone-based visual support technology using augmented reality and computer vision to provide high-quality remote customer support and service at lower cost.