The amount of 42 million dollars in order to further grow and finance future acquisitions was raised by FactorTrust, a fintech company based in Atlanta, USA.

As for the funding process, it was led by MissionOG along with ABS Capital Partners.

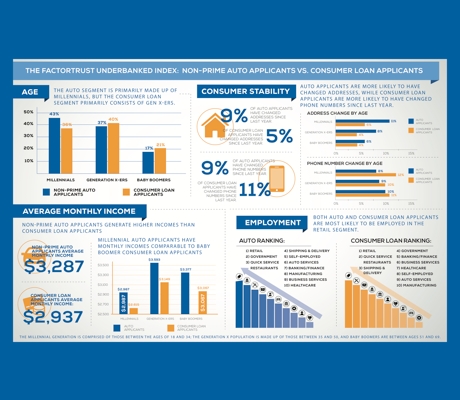

FactorTrust’s software uses proprietary data not available from traditional credit bureaus to enable lenders to more accurately assess credit risk for non-prime and underbanked consumers, according to a statement.